Institutional-Grade Residential Land Investments Since 2008

Blu Onx specializes in institutional-level residential land investments designed to deliver stable growth and carefully managed risk. Our disciplined approach combines rigorous due diligence, strategic relationships, and meticulous planning – transforming carefully selected properties into premier residential communities located in high-demand markets with strong growth potential.

With more than two decades of combined expertise, our seasoned leadership team has successfully navigated changing economic cycles and consistently delivered reliable outcomes. Through transparent investor communication, conservative deal structuring, and an unwavering commitment to quality and excellence, Blu Onx has earned the trust of accredited investors nationwide who value dependable returns and thoughtful stewardship of their investments.

Blu Onx leverages strategic land acquisitions, pre-sold lots, and disciplined project oversight to deliver exceptional risk-adjusted returns. Our proven investment model is designed to protect investor capital while generating stable, predictable growth – without speculative exposure.

Secure buyer commitments upfront, significantly reducing market risk and ensuring predictable returns.

Focus exclusively on prime locations in high-demand growth markets and top-ranked school districts.

In-depth market research and meticulous vetting of every investment opportunity.

Conservative project structuring, contingency planning, and careful capital allocation to protect investments.

Regular, clear updates keep investors informed and confident at every project stage.

Land moves through several stages on its path from raw acreage to a fully developed neighborhood. Each stage carries distinct responsibilities, capital needs, and risk exposure. Blu Onx operates at the point where value creation accelerates through disciplined entitlement work and horizontal development.

Undeveloped land with future residential potential. Often held by landowners, long-term investors, or institutional land banks.

Blu Onx acquires strategically selected sites, secures zoning and approvals, installs roads, utilities, stormwater systems, and prepares finished lots under committed builder takedown schedules. This stage converts raw land into shovel-ready lots with predictable exit pathways.

National and regional homebuilders begin construction on completed pads and manage labor, materials, and home sales.

Families move in, and the community reaches stabilization as long-term value transitions to homeowners and institutional capital.

Blu Onx is exclusively focused on Stage 2, where disciplined development, rigorous controls, and pre-sold builder commitments create stable, durable value for investors.

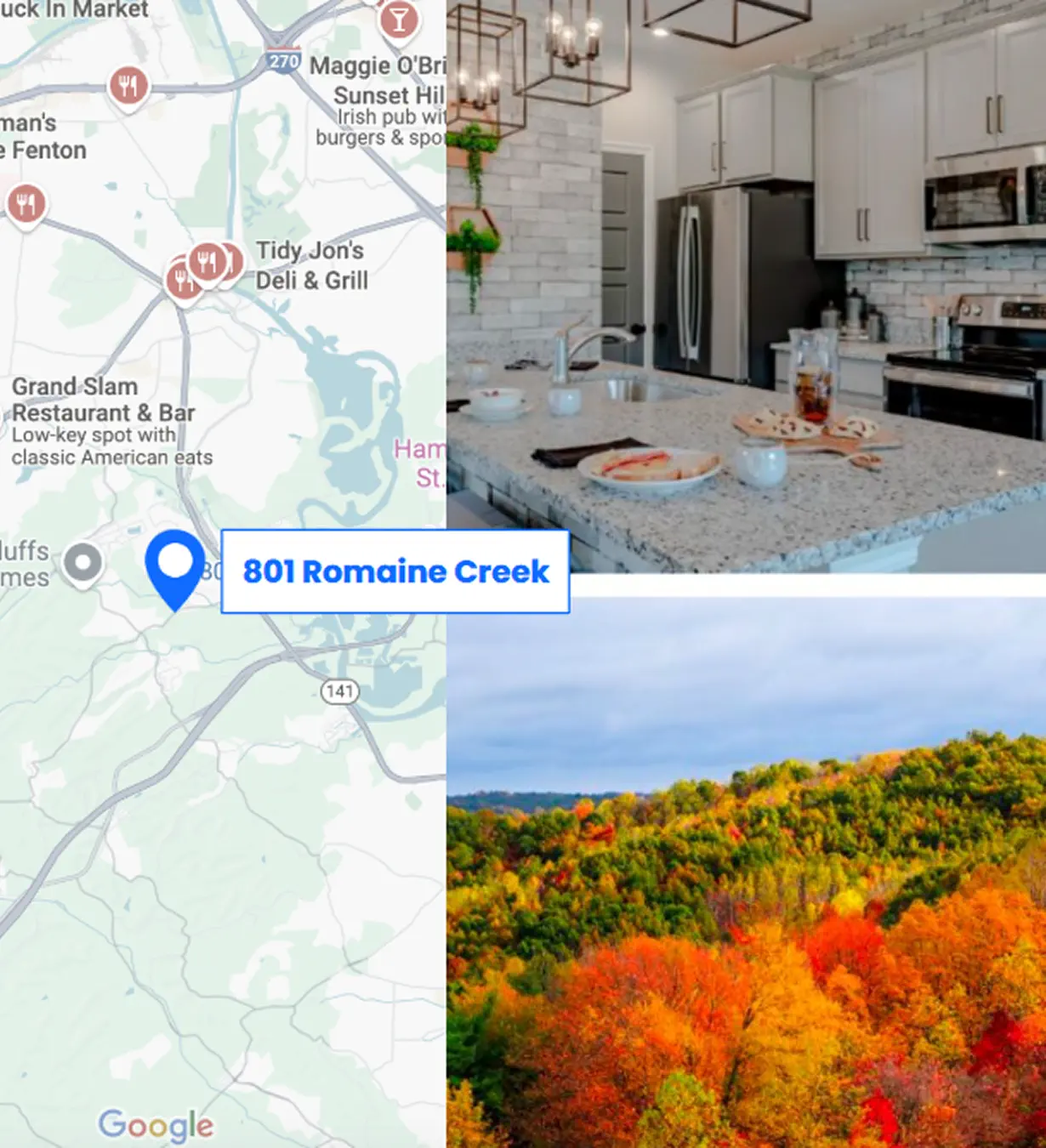

This 8.1-acre development in Fenton, MO, presents an exceptional opportunity to invest in 40 prime residential lots. Valued at $2,863,600, this project is positioned for strong returns, thanks to Fenton's growing real estate market and the project's pre-sold lots. This translates to a secure investment with minimized risk and predictable returns.

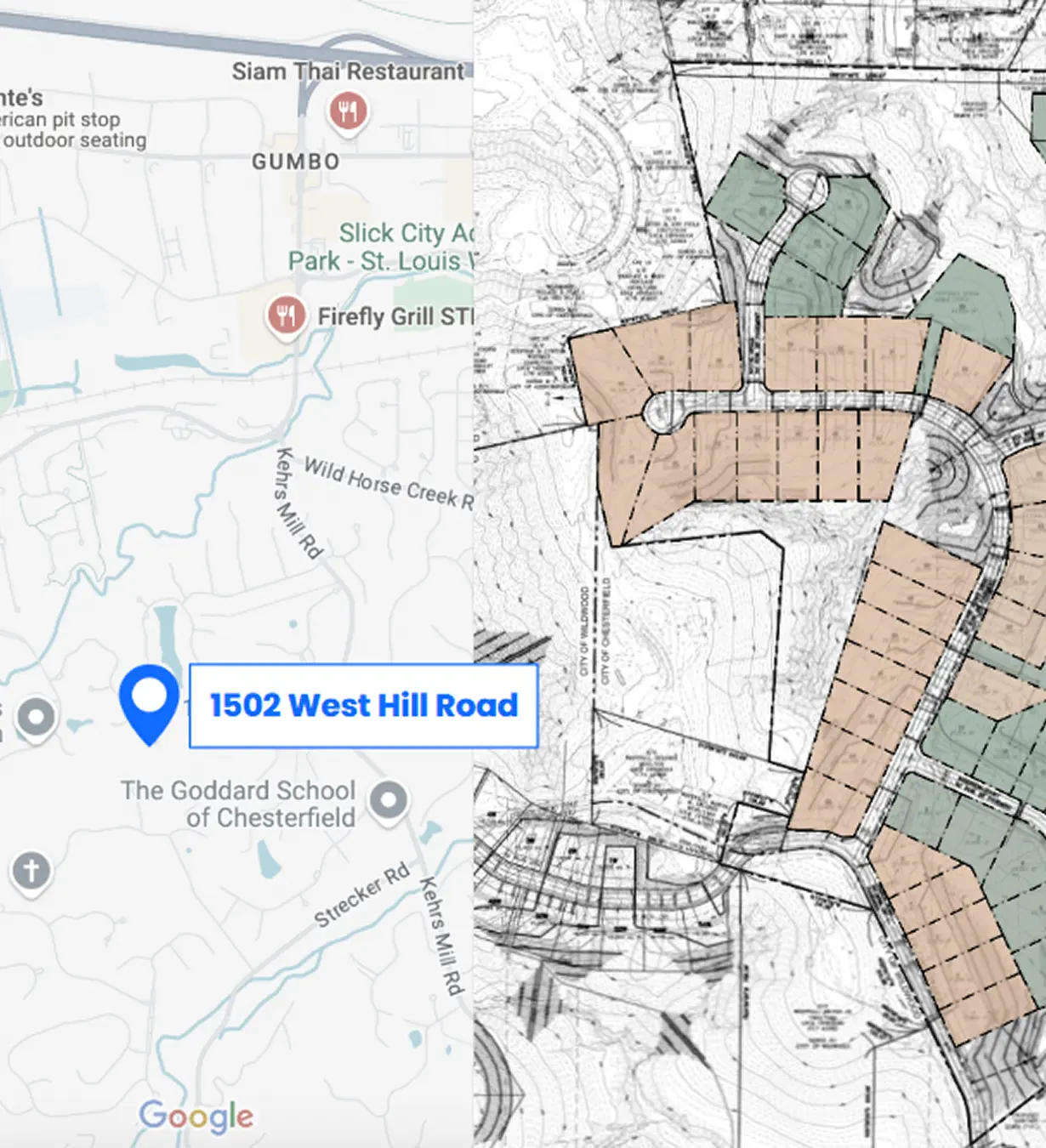

This expansive 57.41-acre development in Chesterfield, MO, offers a significant investment opportunity valued at $20,250,000. Chesterfield's excellent schools and strong local economy make it a highly desirable location for families. With substantial growth potential, this project promises a strong return on investment.

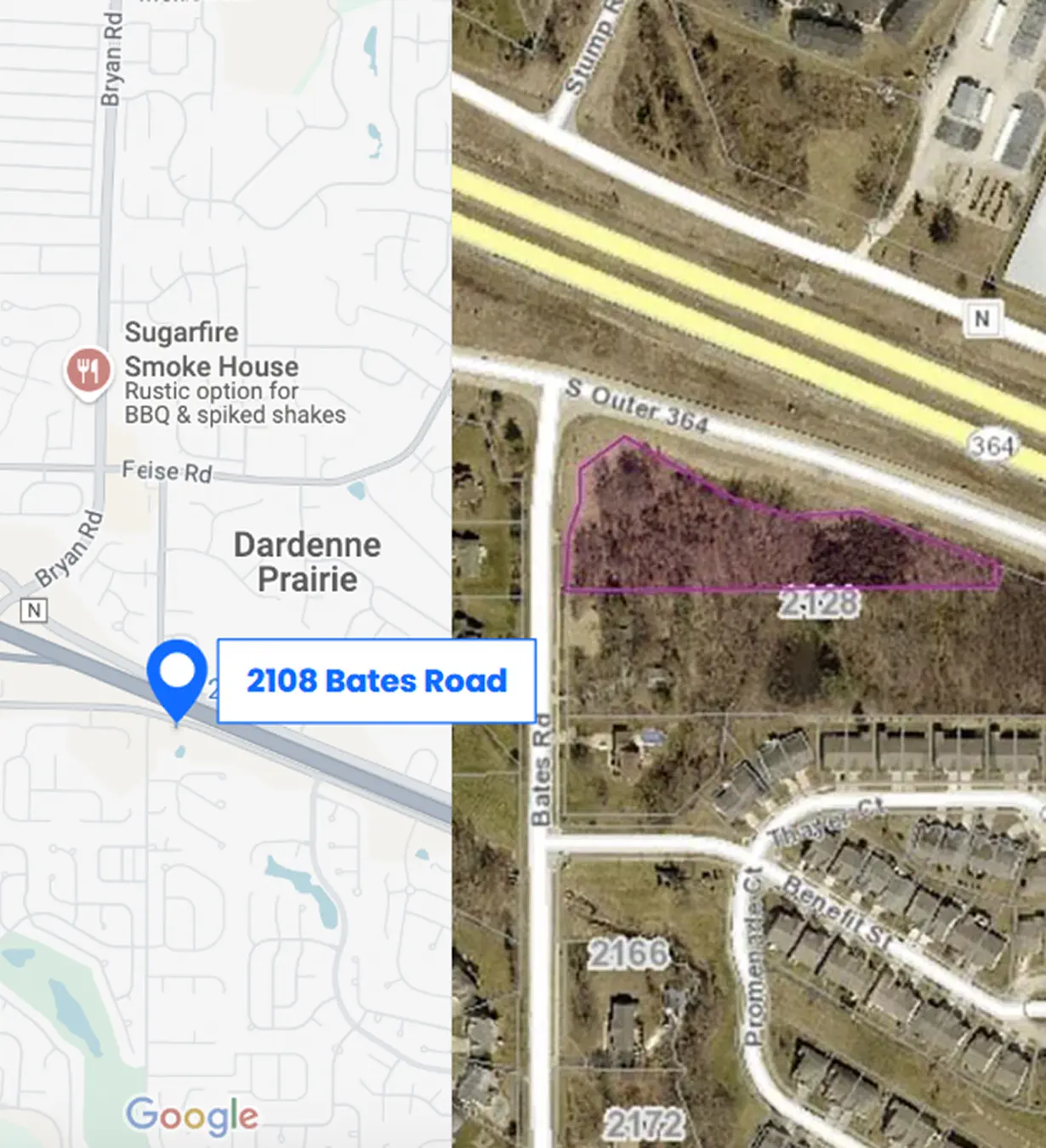

This 9-acre development in Dardenne Prairie, MO, valued at $3,451,000 offers excellent potential for investors seeking steady returns. Dardenne Prairie's strong local economy and growing population provide a solid foundation for long-term appreciation. Pre-sold lots mitigate risk and maximize investment security.

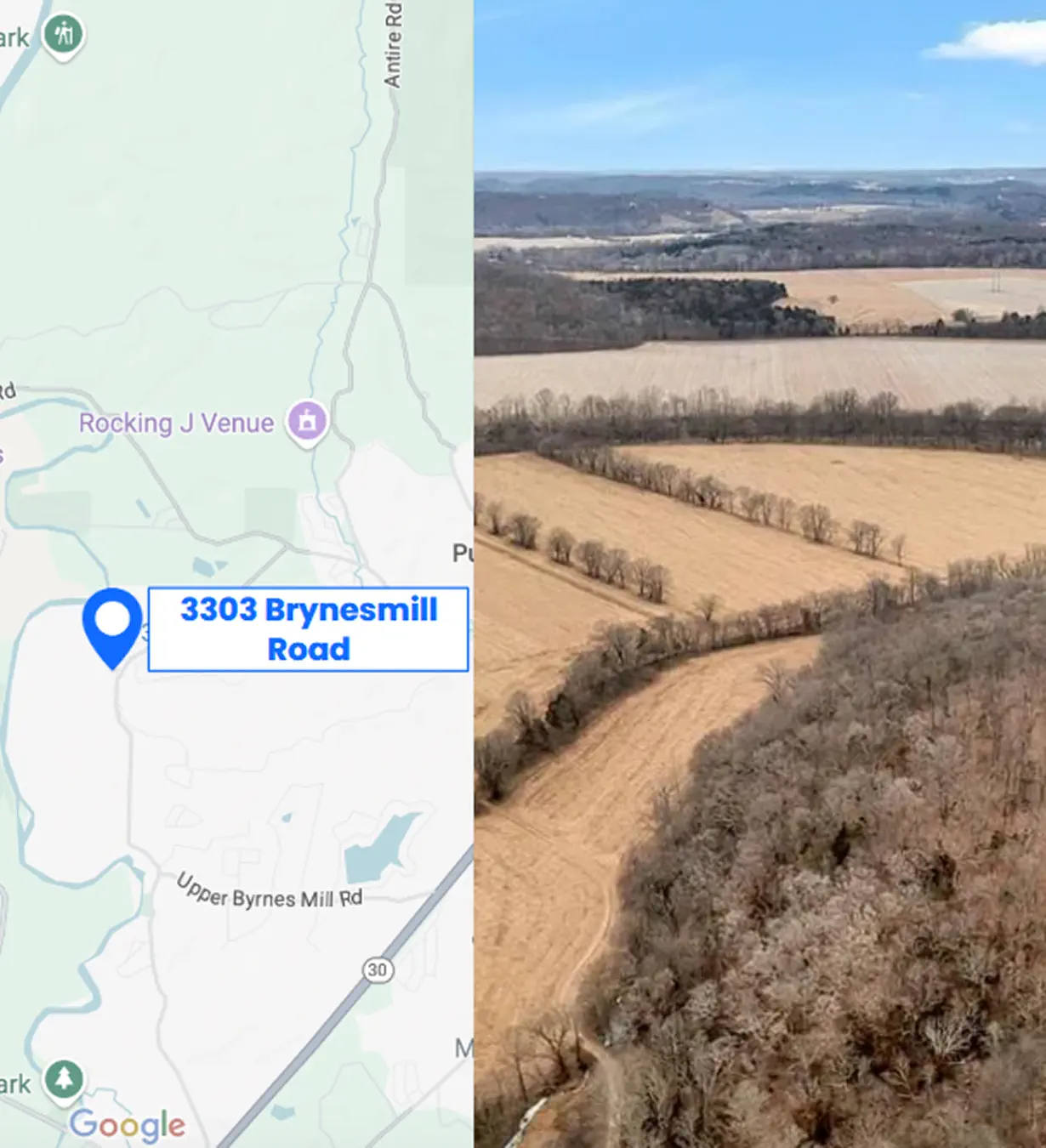

This substantial 133-acre development in Eureka, MO, valued at $16,375,038, presents a significant investment opportunity in a highly desirable location. Eureka's charm and excellent schools make it an attractive area for families, ensuring sustained demand for new housing. Invest with confidence in this exceptional development.

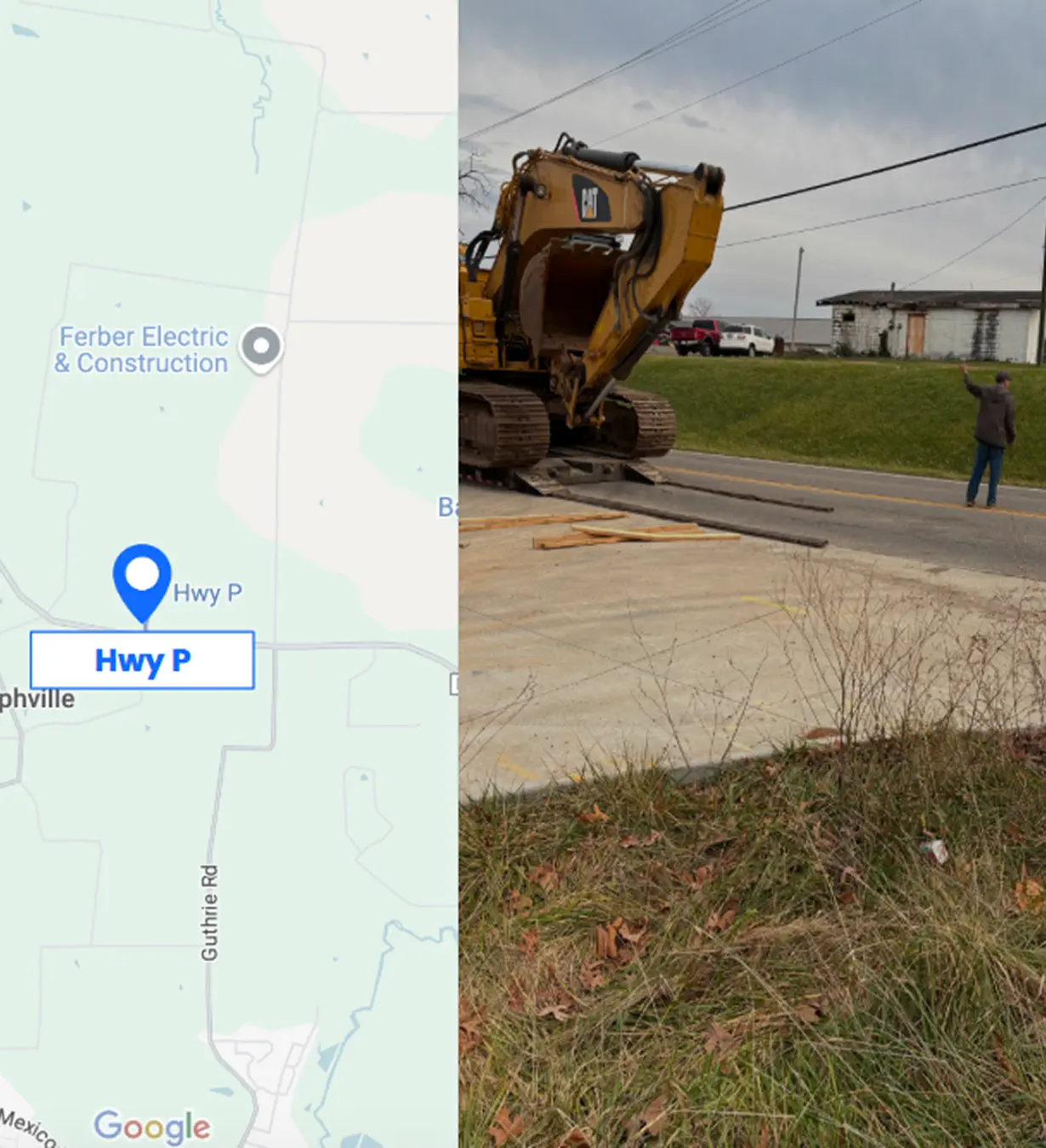

Capitalize on the growth in Flint Hill, MO, with this 45-acre development opportunity. Valued at $7,084,800, this project offers easy highway access and is located in a rapidly expanding community, making it a smart choice for long-term growth.

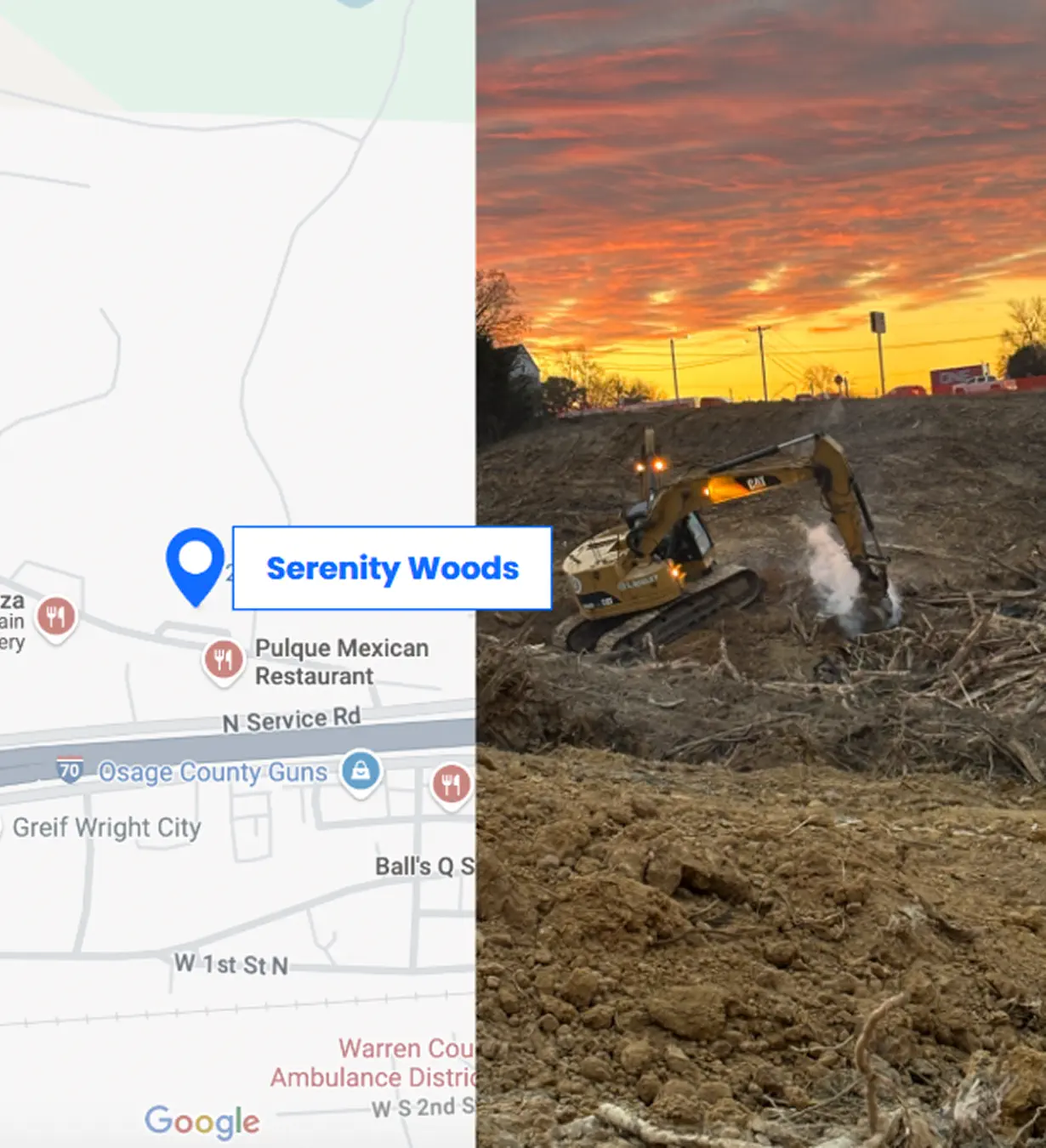

Serenity Woods is a extensive development in Wright City, MO, spanning 53 acres with an additional 66 acres slated for acquisition, totaling a value of $9,096,600. This large-scale project provides diverse investment options within a booming real estate market. This impressive development is perfect for investors seeking scale and significant returns.

Residential land is now one of the most constrained and sought-after real estate assets in the country. National builders are actively pursuing shovel-ready land in key growth markets – yet the supply remains far below what’s needed.

Blu Onx identifies these high-demand regions early, aligning each project with long-term demographic shifts and institutional capital trends. Our model ensures every development meets real demand, not just speculative growth potential.

Blu Onx focuses exclusively on horizontal residential land development, not vertical construction. Every lot is pre-sold to a national builder before development begins – eliminating speculative risk. We also operate with conservative deal structuring, rigorous site vetting, and complete transparency with our investors from day one.

Investor funds are only deployed into projects that have undergone detailed due diligence, builder pre-sale agreements, and title/entitlement clearance. There is no capital at risk until the property is shovel-ready.

We target 15% to 18% annualized returns, with quarterly payouts beginning within Year 1. Returns are tied to takedown schedules secured with national builders.

We work with some of the largest homebuilders in the U.S., including Fischer Homes. Builders are selected based on track record, absorption capability, and market presence.

Investors receive quarterly updates, financial reporting, and project milestone briefings. Transparency is a core value at Blu Onx.

Our model is designed to protect capital, reduce risk, and generate dependable outcomes for accredited investors seeking long-term value.